Pennsylvania 2021 Wage Loss Benefits Lawyer

One of the key elements of Pennsylvania’s workers’ compensation is law is wage-loss benefits. These benefits are meant to indemnify an injured worker against the loss of their weekly paycheck while recovering from a job-related injury. Unfortunately, wage-loss benefits are not a 100 percent replacement. Instead, the actual benefit amounts are subject to certain legal minimum and maximum ranges that change each year.

What Are the Workers’ Compensation Rates for 2021?

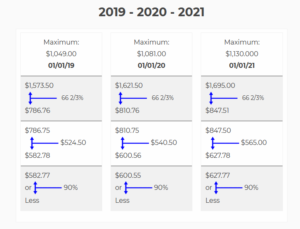

As of January 1, 2021, the maximum weekly compensation rate under Pennsylvania workers’ compensation is $1,130.00. This means no matter how much your pre-injury wages were, you cannot receive more than this $1,130.00 per week in workers’ compensation.

The actual compensation rate depends on the injured workers’ average weekly wage prior to their accident or occupational illness. There are essentially three tiers for determining compensation:

- If your average weekly wage was between $847.51 and $1,695.00, your wage-loss benefits will be 66-and-2/3 percent of your average weekly wage. For example, if you were previously earning $900.00 per week, you would receive $600.00 per week in workers’ compensation benefits. And as noted above, there is an overall maximum of $1,130.00 per week, which represents two-thirds of $1,695.00.

- If your average weekly wage fell between $627.78 and $847.50, then your workers’ compensation wage-loss benefit is $565.00.

- If you earned $627.77 or less per week prior to your injury, then your wage workers’ compensation wage-loss benefit is 90 percent of your average weekly wage. So let’s say you were earning the Pennsylvania minimum wage of $7.25 per hour, or $290 per week. If you were injured at work you could expect to receive workers’ compensation benefits of $261 per week.

How Do Compensation Rates Differ from 2020 to 2021?

It is important to note that the applicable workers’ compensation rates are based on when the actual injury or occupational illness occurred. In other words, the rate schedule described above only covers workers’ compensation claims arising on or after January 1, 2021. If you were injured last year, your claim would still be subject to the rate schedule in effect for 2020.

Pennsylvania law slightly modifies the maximum benefits and individual tiers annually. For 2020, the maximum weekly benefit allowed was $1,081.00, which is $49.00 lower than the 2021 maximum of $1,130. The tiers for 2020 also break down as follows:

- You will receive two-thirds of your average weekly wage if you were earning between $810.76 and $1,621.50 per week.

- You will receive a benefit of $540.50 if you were earning between $600.56 and $810.75 per week.

- You will receive 90 percent of your average weekly wage if you were earning $600.55 or less per week.

Speak with a Pennsylvania Workers’ Compensation Lawyer Today

Workers’ compensation law is often confusing to people who have never dealt with the system before. If you need guidance or legal representation in connection with a claim, it is best to speak with a qualified Wilkes Barre workers’ compensation lawyer. Contact the Figured Law Firm today at 570-954-9299 to schedule a consultation.